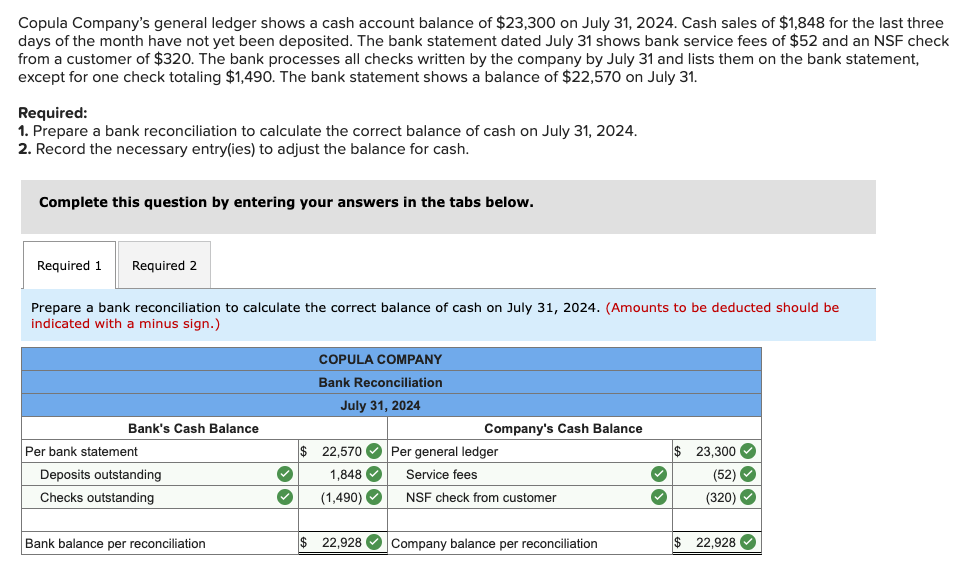

The program techniques having first-big date homebuyer offers inside the Iowa usually concerns filling out a software function and getting help data files including earnings confirmation, evidence of residence, and you will borrowing from the bank recommendations. It is essential to carefully review the requirements and you will recommendations press the site just before submission the application.

Down payment Recommendations software in Iowa promote money to help you basic-date homeowners whom get have a problem with protecting to own a downpayment. These types of applications provide grants, money, otherwise forgivable financing used to the advance payment and you may closing costs from a separate family. They make an effort to build homeownership so much more available by detatching the new upfront expenses associated with to acquire a property.

Recapture Tax & Conditions and terms

Whenever engaging in brand new FirstHome program when you look at the Iowa, it is very important be aware of the prospective recapture tax. Thus for folks who sell your house in this a particular schedule, you might have to pay-off an element of the direction given. Make sure you remark most of the terms and conditions and you can learn the debt just before getting into people homebuyer guidelines programs.

Financial assistance getting Homeowners from inside the Iowa

Financial assistance having Homebuyers in Iowa includes statewide and you will local software, and local applications. This type of apps provide advice about down repayments, closing costs, and other costs associated with to shop for property. They aim to generate homeownership inexpensive and obtainable to possess basic-date people.

Statewide and Regional Applications

Statewide and you can regional programs from inside the Iowa promote even more financial help getting first-date homebuyers. Such applications are designed to help somebody and parents that have lower in order to reasonable revenues go the imagine homeownership. Giving grants, advance payment assistance, or any other tips, this type of apps create to invest in a house cheaper and you can accessible.

Regional Applications

Also statewide and you may local programs, there are also regional software within the Iowa that provides financial assistance to help you earliest-day homeowners. Such applications may differ off area in order to town and gives gives, money, or deposit recommendations specifically targeted at local owners seeking to pick its earliest home. Contact your regional property expert or people development office for more information about new available programs near you.

Extra Capital Tricks for Earliest-Date Homebuyers

Must i capture very first-time homebuyer groups? Absolutely! These categories offer valuable pointers and you will info in order to navigate the newest homebuying procedure. Do earliest-date homebuyers having poor credit qualify for homeownership advice? Sure, you can find programs available specifically designed for those that have less-than-prime borrowing.

Could there be a primary-time homebuyer tax borrowing from inside the Iowa? Unfortunately, already, Iowa cannot render a particular income tax borrowing having first-day homebuyers. Could there be a first-day veteran homebuyer guidelines system when you look at the Iowa? Sure, veterans s and you may guidance. What credit rating carry out I want to have very first-day homebuyer direction in Iowa?

When you are requirements are different of the program, with a top credit history increases your chances of being qualified getting recommendations. What’s the mediocre ages of basic-big date homeowners for the Iowa? Centered on previous investigation, the average age of earliest-day customers within the Iowa is approximately thirty-two years of age.

Ought i need first-go out homebuyer kinds?

Delivering very first-day homebuyer classes is highly recommended. Such classes bring worthwhile information regarding the homebuying techniques, in addition to budgeting, home loan alternatives, and you may insights deals. They could help you create advised decisions and you will navigate the new complex field of homeownership confidently.

First-date homebuyers with poor credit s. Whilst each system features its own qualification conditions, some options provide flexible criteria and lower credit rating thresholds. It is critical to research and you may talk about this type of apps to determine when the youre qualified to receive the support you would like.

Is there an initial-time homebuyer taxation borrowing from the bank inside the Iowa?

Yes, there is certainly a first-date homebuyer taxation borrowing from the bank in Iowa. That it income tax borrowing allows qualified visitors to discovered a portion of the home loan attention just like the good deduction on the county taxes. It is important to browse the specific standards and you will limitations of the borrowing before applying.

Last Updated on November 14, 2024 by Bruce