Contemplating taking out fully an interest rate? Here are the most recent home loan rates and ideal things that determine all of them.

Financial prices fluctuate just about every day predicated on economic climates. Listed below are the present financial costs and you can what you need to discover from the acquiring the top rates. ( iStock )

The fresh new average rate of interest with the a 30-seasons fixed-rate mortgage was 6.375% as of August 14, which is 0.115 percentage facts below yesterday. Concurrently, the brand new median interest rate into the a great fifteen-year repaired-rate home loan is 5.625%, that’s unchanged regarding yesterday.

Analysts are hopeful that lower interest rates are on the horizon. The Federal Reserve has indicated that a cut right out will be sensed within the September.

Which have home loan costs switching every day, it is advisable to check the current rates before you apply to possess that loan. You’ll want to contrast some other lenders’ most recent rates, words and charge to be sure you earn a knowledgeable price.

Median interest levels last up-to-date . Costs is actually calculated based on analysis out of more than 500 lenders throughout 50 says. Legitimate gathers the details on a daily basis by using the following the information: $eight hundred,000 purchase price, $80,000 advance payment, single-loved ones top household, and an excellent 740+ FICO rating.

- Just how do financial cost functions?

- Exactly what establishes the loan speed?

- Simple tips to compare home loan prices

- Advantages and disadvantages out of mortgage loans

- How exactly to qualify for home financing

- How to make an application for a mortgage

- How-to refinance a home loan

- How exactly to supply the home’s collateral

- FAQ

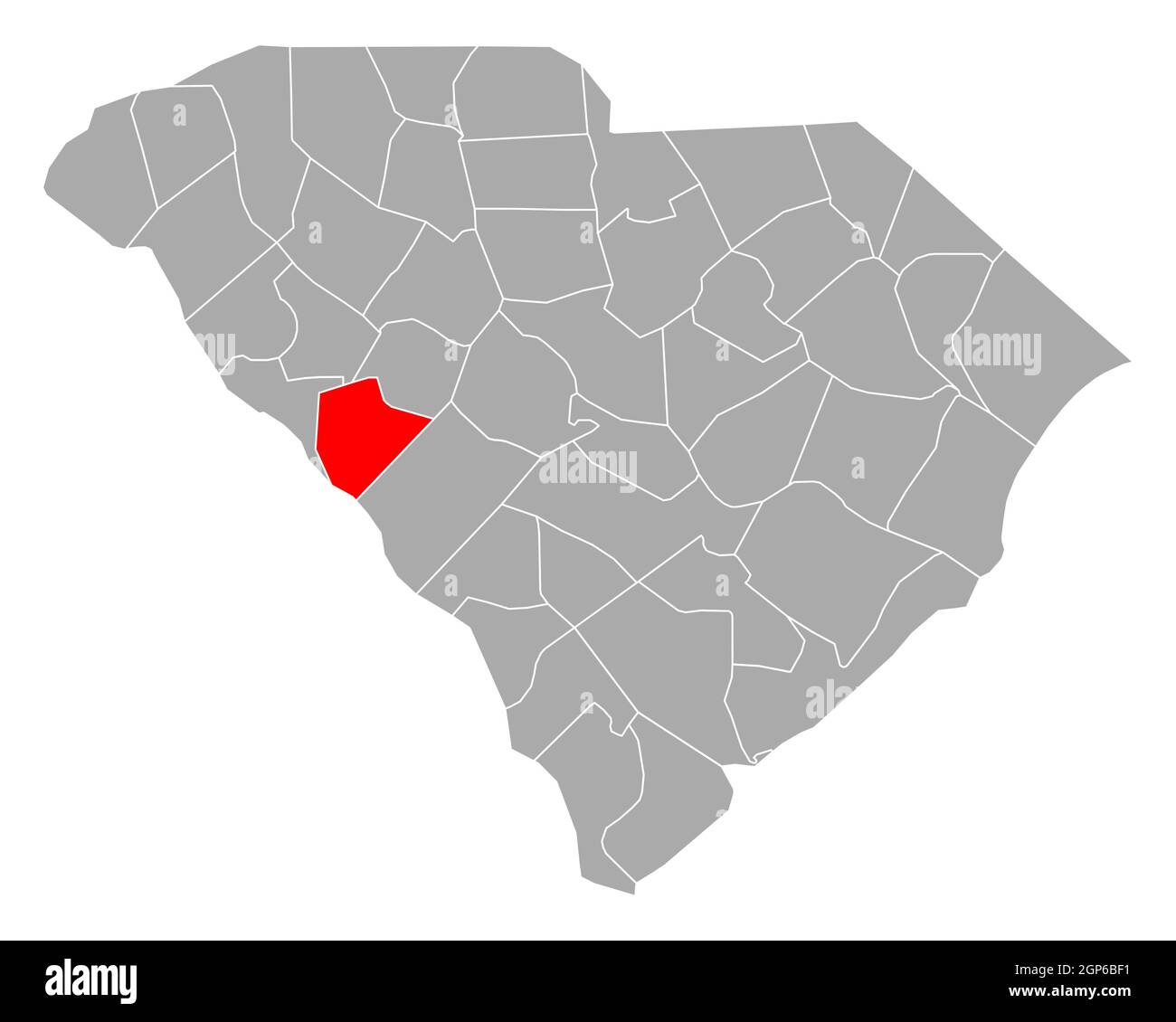

Montgomery payday loans online

How can home loan cost performs?

When taking out an interest rate to shop for a house, you happen to be borrowing from the bank money from a loan provider. So that financial and also make a profit and relieve chance in order to by itself, it can charges interest to the prominent – that is, the amount you borrowed.

Expressed as a percentage, a mortgage interest rate is essentially the cost of borrowing money. It can vary based on several factors, such as your credit rating, debt-to-money proportion (DTI), down payment, loan amount and repayment term.

After getting a mortgage, you’ll typically receive an amortization plan, which shows your payment schedule over the life of the loan. It also indicates how much of each payment goes toward the principal balance versus the interest.

Around the start of the financing term, you can save money money on focus and less into the dominant harmony. As you strategy the termination of the fresh new fees title, you’ll shell out even more to the the principal much less into interest.

Their home loan rate of interest shall be either repaired or variable. With a predetermined-rate home loan, the rate was consistent during the loan. Which have a varying-rate home loan (ARM), the rate normally change on the field.

Remember that a good mortgage’s interest rate is not necessarily the identical to its apr (APR). Simply because an apr comes with both interest and you can any other lender costs otherwise fees.

Home loan prices transform seem to – either on a daily basis. Rising cost of living performs a significant character within these activity. Interest levels usually increase in symptoms out of higher rising cost of living, while they have a tendency to drop otherwise continue to be roughly an equivalent from inside the times of low rising prices. Additional factors, such as the economy, consult and you will catalog may change the latest mediocre mortgage cost.

To find great mortgage rates, start by using Credible’s secured website, which can show you current mortgage rates from multiple lenders without affecting your credit score. You can also use Credible’s financial calculator to estimate your monthly mortgage payments.

What establishes the loan rates?

Lenders typically determine the interest rate to your a situation-by-circumstances basis. Fundamentally, it put aside a decreased prices for low-risk individuals – that’s, those with a higher credit score, income and downpayment number. Here are a few other private items that may influence their home loan rate:

Last Updated on November 22, 2024 by Bruce