Withdrawing your money from such an account before the term has ended typically results in a penalty. In exchange for locking away your money, time deposit accounts often pay higher yields than demand deposit accounts. Unlike a savings account, a checking account is a type of demand deposit account that doesn’t limit the number of transactions you can make without paying a fee. Like savings accounts, checking accounts are often covered by FDIC or NCUA insurance.

Types of demand deposit accounts

Savings accounts, money market accounts and NOW accounts may set monthly transaction limits or require you to give advance notice before accessing your cash. A demand deposit account, or DDA, is a type of bank account that you can withdraw from on demand. The most common types of DDAs are checking and savings accounts, but money market accounts are also considered payable on demand. Learn about some of the key benefits and drawbacks of demand deposit accounts, how they work and how to open one. Banks can pay interest on demand deposit accounts, though, with checking accounts, this typically isn’t the norm.

Checking Account

She’s been writing about personal finance since 2014, and her work has appeared in numerous publications online. Beyond banking, her expertise covers credit and debt, student loans, investing, home buying, insurance and small business. Different banks use the term as per their internal definitions, so if you don’t recognize the transaction or you are still confused, I recommend you check your bank’s terms and conditions. Alternatively, just give their helpline a call and they can hopefully sort things out for you.

Force Pay Codes

- After you’ve chosen which account you want to open, you will likely be asked to make an initial deposit to finalize the account.

- Although rarely if ever exercised in practice, banks must still reserve the right to require seven days’ advance written notice for an intended withdrawal.

- With DDAs, unlike some other forms of account (such as a savings account), you do not need to notify your bank ahead of any transactions or withdrawals.

- Welcome to the world of banking, where acronyms abound and the jargon can sometimes leave you scratching your head.

- Each type of account can be useful, depending on your financial needs and goals.

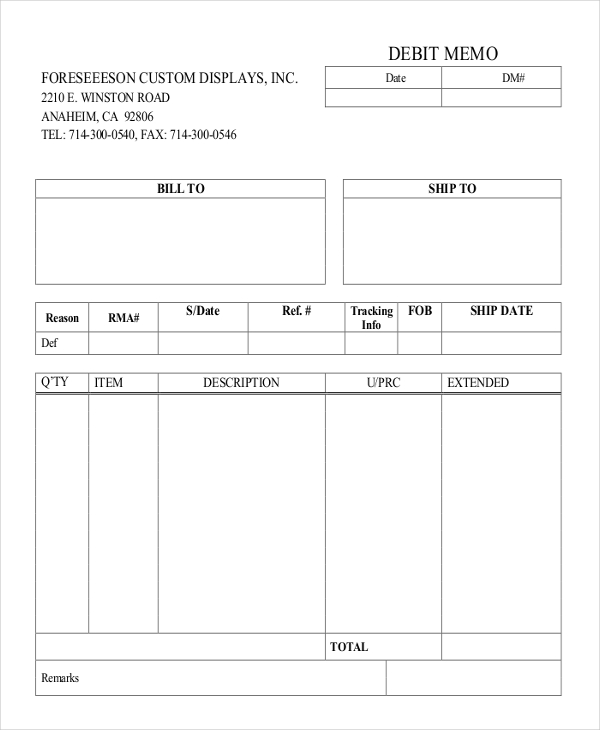

These are common daily scenarios for many of us, and in any of these situations, we need access to our money immediately. A demand deposit simply removes money requested dda debit memo as and when required – there’s zero need to speak to anyone official to authorize it. If you are concerned, it is best to contact your bank directly about the deposit.

But they differ in accessibility or liquidity, and in the amount of interest that can be earned on the deposited funds. When compared to traditional savings accounts, money market accounts generally offer higher interest rates to depositors. But banks can limit the number of withdrawals you can make from an MMA, just as they can with savings accounts. For example, you may be restricted to six withdrawals per month before an excess withdrawal fee kicks in. In terms of whether CDs or money market accounts pay better interest rates, this can depend on the type of CD or MMA and where you’re opening it.

Money market accounts

Otherwise, you could end up paying high fees for falling below specified account balances or withdrawing more than your account agreement permits. It’s hard to believe that, with some accounts, you’ll still need to consult a teller or customer representative to authorize payments! This is a matter of security, of course – but DDAs are perfect for everyday purchases.

For instance, typically, the longer the CD term is, the higher the rate. Jumbo CDs, which may require you to deposit $25,000 or more, can earn higher rates than CDs that only require a $500 or $1,000 deposit. The same goes for jumbo money market accounts versus regular money market accounts.

Such an account lets you withdraw funds without having to give the financial institution any advance notice. If depositors were required to notify their banks in advance before withdrawing funds, it would be quite a challenge to obtain cash or make ordinary transactions. Demand deposit accounts are intended to provide ready money—the funds that people need to make a purchase or pay bills. DDA debit refers to a direct debit authorization while DDA accounts refer to a demand deposit account. For example, if you recently opened a US bank account without an SSN or ITIN, you will likely see direct debit mandate or ACH authorization instead of DDA debit. Once your deposit account reaches maturity after the specified term, you can withdraw the money you deposited initially, along with interest earned.

Thus, you should be able to withdraw money to cover purchases at any time. Checking accounts can be negotiable order of withdrawal accounts, though whether it makes sense to choose a NOW account as your primary checking option can depend on how you use it. If you’re regularly making purchases, withdrawals or paying bills, then a NOW account could be inconvenient if you have to give the bank a week’s notice before tapping your funds. A bank may use force pay if they covered a transaction your account didn’t have the funds to cover the day before, but this will not prevent any applicable overdraft fees. The force pay transaction is usually processed once you made a deposit that brings your account back into the positive. You’re still liable for the overdraft because your account was or went into the negative by the debit, even though the bank covered it.

Last Updated on November 13, 2024 by Bruce