Property owners think applying for a house Guarantee Line of credit (HELOC) many different factors. Frequently, he or she is trying to build renovations otherwise finance a school studies. Either, he is trying to bundle an aspiration trips otherwise has a beneficial back-up out of money on hand in case of a crisis. Dependent on your unique finances, an effective HELOC could be the proper second monetary action to you.

What is a HELOC?

HELOCs are made to put your home’s equity working having you. This basically means, HELOCs can get allows you to borrow secured on the brand new collateral in your family without having to pay regarding very first home loan. Having a great HELOC, you are given a specific credit line, dependent on the value of your house and left balance towards your home loan. To own a simplified example a couple owns a home well worth $250,000, and currently are obligated to pay $150,000 on their first mortgage. It indicates, theoretically, he’s $100,000 during the collateral. But not, the degree of one to security they are able to borrow on can differ, according to the financing system.

Having Camden Federal Financial, anybody can submit an application for a beneficial HELOC through our very own on the web software program MortgageTouch. From the mobile phone, tablet otherwise computer, you can properly submit all requisite records and you will advice and implement having benefits.

How do HELOC money performs?

An excellent HELOC makes you make monitors (removed contrary to the designated personal line of credit) as needed through the a designated time referred to as Mark Several months, which is typically a decade. HELOCs are arranged with an adjustable rate of interest, which means that the pace you only pay is not fixed-it might increase or off over time.

Into the Draw Several months, you are required to make minimum payments considering your balance (but you can usually pay much more). According to mortgage, the brand new commission could be in line with the latest balance, the fresh new applicable interest, or other things. The percentage can be change since these numbers change

At the end of the Draw Several months, you enter the Installment Identity. During this time, the new range cannot be utilized. Costs toward present balance is amortized along the Repayment Label in order to pay both dominant as well as the interest.

What are the trick benefits of HELOCs?

Before everything else, you pay for cash you use (we.e. you might not need to pay interest on money you do not use from the designated credit line). On top of that, costs can be less than unsecured loans or playing cards. You could potentially pertain just after to own a HELOC and you Garden City payday loan online will, if the recognized, you need to use the credit line several times inside Draw Months. Because you consistently generate money, those funds be available for you to use once more into the Draw Period. Fee amounts is also versatile-your own fee is really as lower since desire-merely commission, but you manage to reduce the borrowed funds during the area or in full when. Make sure that, but not, you know what might lead to very early closeout charge for the HELOC for individuals who pay back your balance very early.

Exactly what it is possible to disadvantages must i believe?

As interest levels are usually susceptible to changes, you may possibly have a higher fee if the interest levels increase. Should your thought of a variable interest rate enables you to scared, you can also consider a fixed-speed loan, like a house Guarantee Loan, which is slightly distinctive from good HELOC.

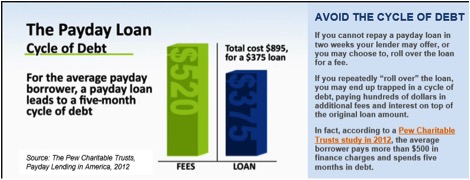

In addition, by using a great HELOC so you can consolidate large rate of interest credit cards, abuse is needed to prevent a period out of overspending. And then make minimum money in mark several months might not pay-off your own range equilibrium. Remember this for the Mark Period, and know their payment may increase somewhat whether or not it turns with the Repayment Period. Make sure to take into consideration your own investing habits and you will potential for even greater debt.

Interested in a great deal more?

The knowledgeable loan originators are here so you’re able to function with the best choices for HELOCs, HELOANs and you may refinancing your own financial. The audience is here to you 24/7 at 800-860-8821.

Last Updated on November 20, 2024 by Bruce