- A 15 otherwise 31-year duration,

- Below-sector, repaired rates,

- Zero required deposit,

- Zero home loan insurance coverage (PMI),

- Zero settlement costs. The lending company covers the costs of the assessment, label, and just about every other charge.

Likewise, a NACA new member may buy down the loan’s rate of interest to cure its monthly homeloan payment subsequent. Homebuyers may use grant currency and other financial assistance to assist choose the family.

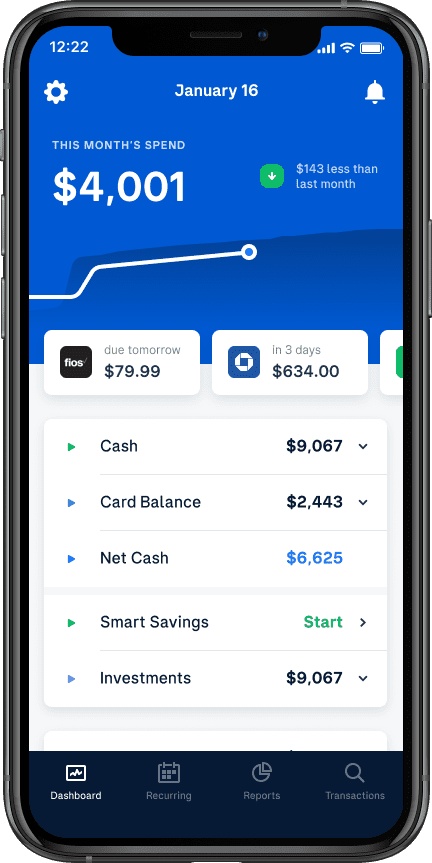

For every step one% of loan worthy of paid off upfront buys down .25% interesting toward a great 15-seasons label mortgage. To own a thirty-seasons name, for each and every step 1.5% of financing really worth reduces the price by the .25%. Such as, an extra $step 1,000 paid on closing to your good $100,000 loan do lessen the rates regarding a great fifteen-12 months financial from 3.00% to 2.75%. Playing with a mortgage payment calculator, you can influence your all the way down price would reduce the month-to-month fee away from $691 so you can $675 and you may save your self $dos,154 within the attract over the longevity of the loan.

The same as compliant mortgage loans, NACA sets a loan restriction otherwise maximum acquisition costs. Higher-listed portion, eg Nyc and you can Boston, accommodate a high buy costs.

If you’re considering to purchase a property with NACA, it is better for connecting with your regional office and talk about the timing of your own pick. New degree processes are extended, and NACA estimates it may take 3 to 6 weeks to be pre-entitled to a mortgage. Once you located acceptance and find a home to find, NACA claims that it takes an average of 21 months in order to romantic.

Sit in a homebuyer workshop (HBW) and start the applying

All of the NACA program professionals need to sit-in a great homebuyer workshop. Next working area, users will have a good NACA ID count. If you wish to continue the application, you’ll want to sign on with the NACA webpage with that ID and upload borrow money online the brand new questioned records.

Intake lesson and monetary guidance

After uploading your financial advice, you could potentially plan an use concept to get economic counseling owing to NACA. Now, the new therapist will help you perform and you can opinion a household finances. To one another, you will understand what tips you need to prior to are NACA-certified. Counselors may also talk about the lingering investment decision needed seriously to buy a home. They could help to put expectations regarding the upcoming will cost you instance resources, possessions taxes, home insurance, HOA dues, domestic solutions, and you will maintenance.

Whenever ending up in an economic counselor, speak about your own aspects of to shop for property. Individuals who dream of home ownership usually wish to capture advantageous asset of a good investment when you look at the a residential property, which can delight in across the long haul. Plus, you can also desire the stability of a construction commission one to really does perhaps not vary up to local rental repayments. Given that a prospective citizen, you ought to prepare to help you finances accordingly. Once you individual your own home, you can attract your spending on things you prioritize in the event it comes returning to upgrades.

Help save the desired funds

Homeowners need certainly to help save into price of property assessment and you can a good pre-payment for possessions insurance rates and you may taxes. Players can also rescue an extra reserve to possess will cost you such as utility places one to then let transition with the homeownership. They must along with save your self the essential difference between tomorrow requested financial fee and you will latest rental percentage.

NACA Qualification

NACA Degree compatible mortgage prequalification. If you have taken the required process to become NACA certified, you are going to dictate an inexpensive mortgage repayment in order to set a house-to shop for finances. It amount tend to typically perhaps not meet or exceed 33% of your disgusting month-to-month earnings but can getting high in more expensive casing avenues. The loan commission and your own more monthly obligations money dont meet or exceed forty% of your disgusting month-to-month earnings.

Last Updated on October 16, 2024 by Bruce