Content

Mortgage brokers utilize it to determine exactly how much you really can afford to fund home financing. Increased DTI may indicate that you have excessively debt and cannot pay the money on the another financial.

In this article, I’ll give an explanation for home loan loans-to-income proportion, how loan providers calculate it, plus the DTI you need to get a home loan.

How-to calculate DTI

So you’re able to determine their DTI, the lender adds up all your month-to-month debt repayments, such as the projected future mortgage payment. Up coming, they divide the entire by the monthly revenues to decide your DTI proportion.

Your own gross month-to-month earnings are $10,000, along with your overall month-to-month personal debt costs are $4,three hundred, for instance the future homeloan payment (PITI).

- DTI proportion = $4,3 hundred / $ten,000 = 43%

In this situation, your DTI proportion would-be 43%. Loan providers essentially like to select a great DTI ratio out-of 43% otherwise less. However, particular will get consider highest percentages, doing 55% into a case-by-instance basis – more and more DTI constraints later.

What is disgusting monthly money?

Disgusting monthly income try a person’s income just before taxes and other write-offs. It includes most of the sources of income, such as for example income, earnings, information, bonuses, and you can mind-work money.

Loan providers make use of your gross monthly income so you’re able to meet the requirements your having an effective home loan. This will help to all of them influence the debt-to-earnings ratio and you can if you can afford the brand new monthly mortgage repayments.

To estimate disgusting month-to-month earnings, add the annual earnings regarding most of the consumers trying to get the financial and divide the total from the amount of days when you look at the the entire year (12).

For individuals who as well as your spouse make an application for home financing, and your mutual annual income are $120,000, the disgusting month-to-month money was $ten,000.

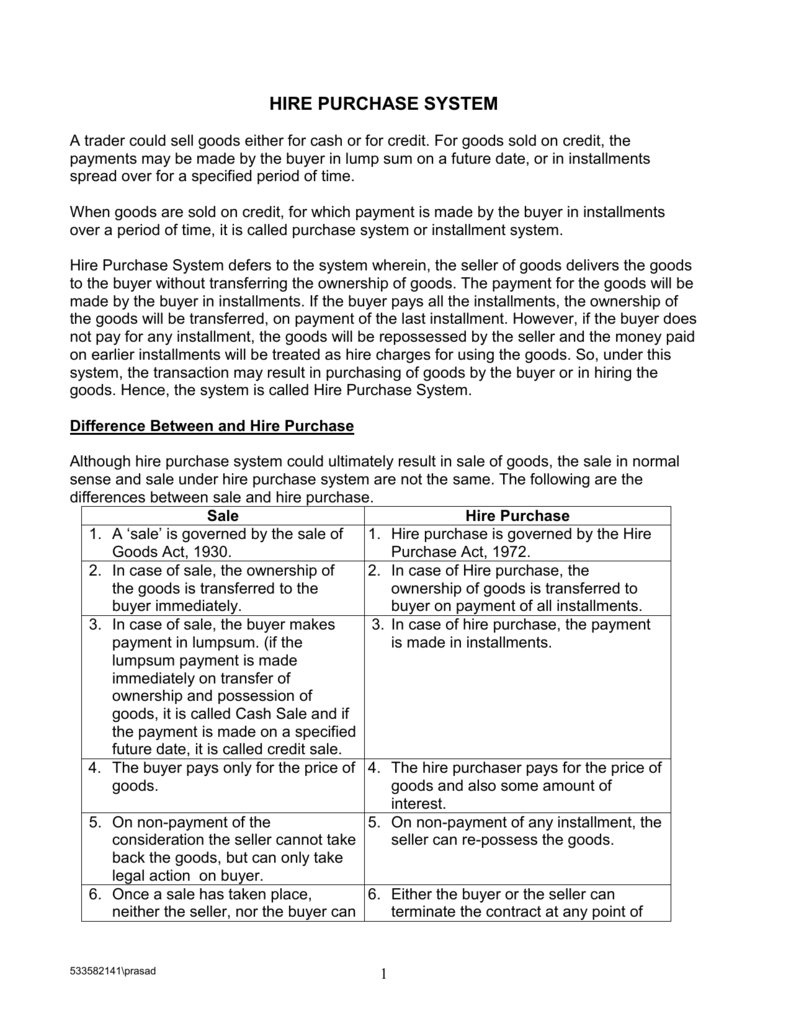

Just what costs manage lenders used to assess debt-to-earnings (DTI)?

- Handmade cards – minimal commission on credit report. Imagine the financing statement will not inform you a minimum matter. If that’s the case, the lender spends 5% of a fantastic equilibrium with the month-to-month loans. Otherwise, they’ll use the payment in your charge card report.

- Cost money , such as vehicle and you can college loans, with well over ten costs leftover

- Most other mortgages and you may home had which you can preserve

- Support repayments – people alimony, youngster assistance, or independent fix repayments you should make not as much as a composed agreement

Lenders use your following mortgage payment – brand new estimated houses percentage of prominent & desire, taxes, insurance, and you can homeowner’s association fees (PITI), in the event that applicable when figuring a great mortgage’s personal debt-to-money (DTI).

Listed below are some the home loan calculator observe the genuine rate and you may monthly payment, along with all components of the new PITI. Up coming, you could potentially become convinced to order a property because you understand what can be expected.

Exactly what expenses carry out loan providers ban whenever calculating your debt-to-earnings ratio getting home financing?

- Bills which you yourself can pay-off within ten days of the financial closure date

- Costs not claimed with the credit file, like power bills and you may medical expense

- Debts reduced because of the others

So you’re able to prohibit loans other people pay, you need to persuade the lender that a person else produced new money on time for at least the very last one year. Loan providers accept 12 months’ financial comments otherwise terminated monitors.

If the debt was home financing, so you’re able to ban it and total month-to-month casing payment (PITI) from your DTI, anyone putting some money need to be on the financial – it signed the loan arrangement.

Let’s say your mother and father co-signed the mortgage you used to pick a house just last year. And since up coming, you have made the latest costs promptly, at least on previous 1 year.

Should your moms and dads submit an application for home financing to order a beneficial re-finance their home, they could ban your debt – your debt regarding the mortgage they co-closed to you, by providing their financial which have copies of one’s financial comments demonstrating you have made prompt mortgage repayments for the past 1 year.

Lenders are able to use https://paydayloanalabama.com/addison/ different methods to own calculating DTI, it is therefore usually a good suggestion to evaluate together with your bank to decide and that expense they’re going to ban throughout the formula.

Is actually DTI limitations some other to possess antique and FHA fund?

The newest DTI proportion limits to have old-fashioned mortgage loans are usually below those people some other sorts of mortgages, particularly FHA otherwise Va fund. Lenders essentially always discover a beneficial DTI ratio out-of 43% or reduced.

To have FHA and you can Va financing, new DTI proportion limitations are generally more than the individuals to possess conventional mortgages. Such as for example, loan providers could possibly get allow it to be a beneficial DTI ratio all the way to 55% having a keen FHA and you can Va mortgage. Although not, this can vary according to the bank or other situations.

DTI proportion constraints getting mortgages vary with regards to the lender as well as your factors. Therefore, it is always good to consult a lender instance NewCastle Home loans on certain DTI proportion requirements.

Exactly how much off home financing ought i afford based on my earnings?

Is a simple way to help you guess simply how much financial you can manage. Contained in this analogy, let’s hypothetically say we need to get a flat and so are searching at a rate diversity.

Start by 1 / 2 of the disgusting month-to-month money. Your own complete month-to-month expense, for instance the coming homes percentage, might be at most 50% of your own gross month-to-month earnings. Anytime your gross month-to-month earnings is $ten,000, upcoming $5,000 will be your restrict monthly loans.

Next, seem sensible your own month-to-month costs. Such as for instance, the college loans are $250, the car can cost you $450, along with your credit card payments is actually $175, to possess $875.

Up coming, subtract the debt out of your earnings to get the limitation construction percentage towards condo, for instance the dominating, interest, taxes, insurance coverage, and you may HOA dues (PITI). $5,000 – $875 = $cuatro,125. Based on such wide variety, you ought to keep upcoming housing payment below $4,125.

Following, you could potentially decide which apartments you really can afford by the calculating the new month-to-month property fee (PITI). Get the property taxes and homeowner’s organization expenses into the Redfin otherwise Zillow. Use our very own mortgage calculator to get into newest costs, money, and you may PMI.

- $eight hundred,000 price

The borrowed funds you can afford utilizes numerous items: earnings, credit score, monthly debt obligations, and coming monthly homes costs.

Once more, that it formula can help you look for a spending budget. Before thinking about homes, score a proven financial pre-acceptance. One of the certified home loan underwriters, the loan decision-founder, confirms your financial pointers so that you discover you are prepared to buy.

Last Updated on October 7, 2024 by Bruce